Key Takeaways

- PayPal is a broadly accepted on-line cost system that means that you can pay for gadgets, obtain funds, and switch cash.

- It gives enterprise accounts, credit score choices, and “Purchase Now, Pay Later” plans for customers.

- It offers purchaser safety, an extra layer of safety, and the comfort of OneTouch funds.

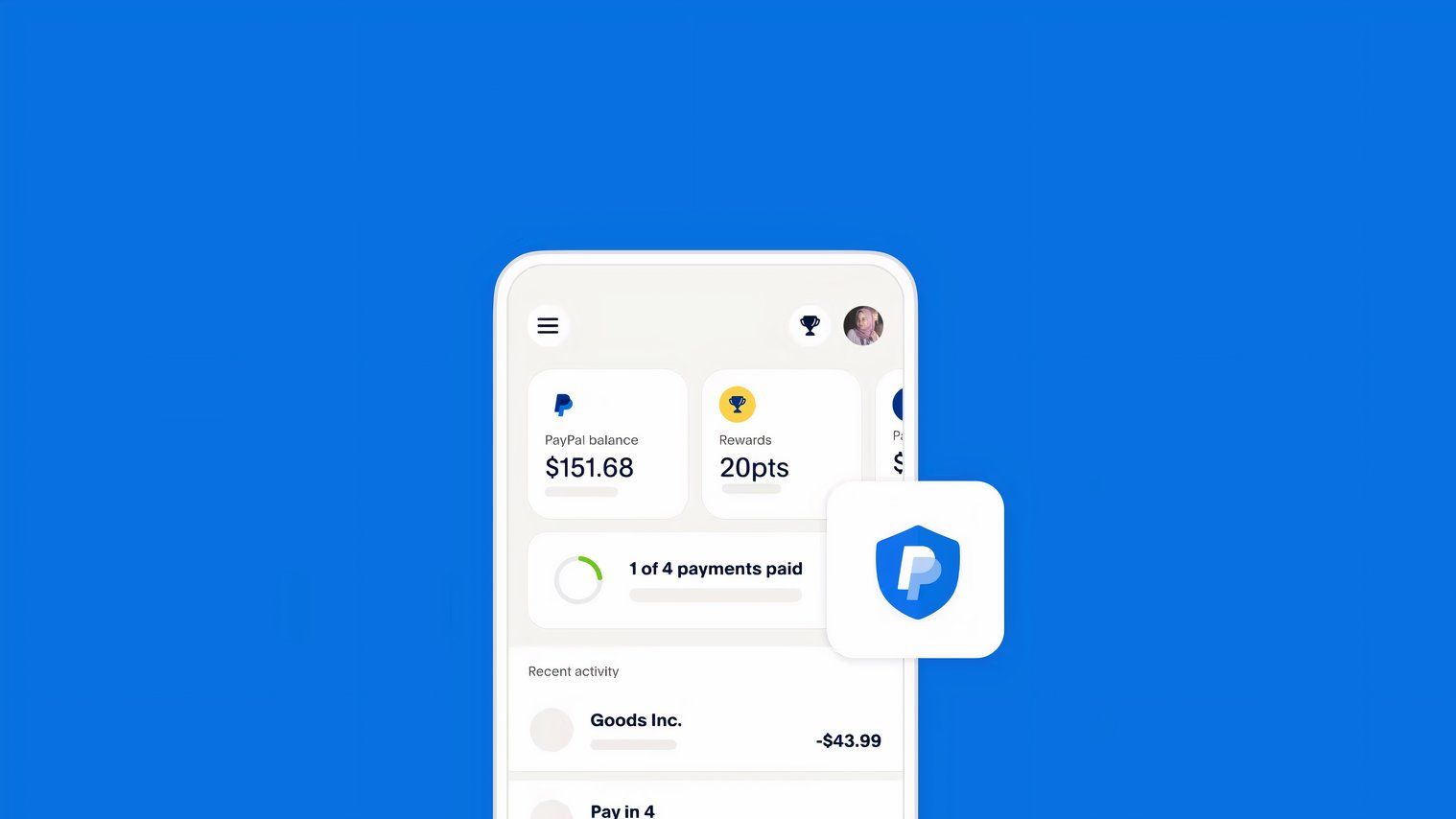

Coping with your cash on-line is all the time a trouble. Whereas there are a lot of choices out there — like banking apps, Venmo, Zelle, and CashApp — there usually appear to be some issues or missing options. Generally it’s the consumer interface, generally there are excessive switch charges. Nevertheless, there may be one longstanding, fashionable selection for making on-line purchases: PayPal. PayPal is a web based cost system the place you may make purchases and even obtain funds with out giving out your banking info to third-parties. Thought of a digital pockets, paying for gadgets with PayPal usually means sooner checkouts and extra safety.

The cellular banking large has been round for years, and goes stronger than ever, mixing up conventional on-line banking with trendy cellular funds and transfers. PayPal encrypts your cost information, so you possibly can take a look at at a web based retailer with out ever sending them your debit or bank card numbers. Moreover utilizing PayPal for on-line purchasing, you should utilize the platform to obtain cash for one thing you bought or a service you offered. PayPal additionally gives some purchase now, pay later choices. This is every thing you might want to learn about PayPal.

Associated

How to quickly delete your PayPal account in four steps

If you happen to’re wanting to make use of a distinct cost service than PayPal, for no matter cause, chances are you’ll be glad to know it is really very easy to shut your PayPal account.

How does PayPal work? 6 issues you are able to do

PayPal encrypts your monetary information, so you possibly can store with out sharing delicate information

PayPal

Merely put, PayPal works by encrypting your monetary information, so you may make funds or obtain cash with out sharing your delicate banking info. PayPal additionally works like a digital pockets, which frequently means trying out with PayPal is commonly sooner, because you simply have to log in and need not retype your cost info or delivery handle.

PayPal’s providers fall into six key classes:

Pay for gadgets

PayPal is among the most well-established and broadly used digital cost programs. It is a web based monetary service that allows you to pay for gadgets utilizing a safe web account. You merely add your checking account, bank card or debit card particulars and everytime you pay utilizing PayPal, you possibly can select which of your playing cards or accounts it pays with. You may also set one to be the default cost methodology and that shall be used until you select in any other case.

Obtain pay

Along with paying for gadgets utilizing PayPal, you may also obtain cash by means of the service. Any cash obtained sits in your PayPal account and can be utilized when paying for one thing, with the stability topped up by your assigned playing cards or checking account.

For small companies, PayPal Zettle is a platform that enables companies to just accept card funds in particular person.

Switch or ship cash

Alternatively, you possibly can switch any constructive stability in your PayPal account to one among your assigned financial institution accounts or playing cards.

There generally is a payment utilized whenever you obtain cash in your PayPal account, nevertheless it’s largely free to make use of when shopping for one thing. It’s free to ship cash to associates or household by means of PayPal accounts too, so long as there isn’t any foreign money conversion required.

PayPal Purchase Now, Pay later

PayPal additionally runs its personal credit score card-style facility for customers, with the choice to pay for merchandise utilizing credit score to pay again later.

Reductions

To prime all of it off, you additionally get some nice offers when paying with PayPal. Not solely does the platform provide nice cashback alternatives, the low cost code extension Honey can also be part of PayPal now. Which means it is well-integrated into the platform, serving to you save much more by discovering eligible coupons and low cost codes in your PayPal purchases.

PayPal for companies

There are additionally enterprise PayPal accounts out there, which you’ll find out more about here. PayPal permits many companies to just accept card funds.

Are you able to ‘purchase now, pay later’ with PayPal?

PayPal gives two alternative ways to pay for purchases on a later date

PayPal gives two “Purchase Now, Pay Later” choices: ‘Pay in 4’ for smaller purchases ($30 to $1,500), permitting prospects to make 4 interest-free funds bi-weekly, and ‘Pay Month-to-month’ for bigger purchases, providing 6, 12, or 24-month plans with APRs starting from 9.99% to 35.99%. A comfortable credit score verify could also be performed however will not affect your credit score rating. Each plans function no sign-up or late charges, and funds could be made by way of debit card, bank card, or a confirmed checking account.

The way to get a PayPal account

Signing up for PayPal is a straightforward course of that requires creating an account and linking your cost info

PayPal

It is easy to join a PayPal account. You head to PayPal.com and click on the Join button. It will ask if you wish to join a private or enterprise account and away you go. Do not forget to have your financial institution, credit score or debit card particulars readily available. The method is extremely easy and, after registering along with your e mail handle, means that you can begin banking in a matter of minutes.

- Go to PayPal web site at PayPal.com.

- Click on the “Signal Up” button on the homepage.

- Select your account sort, both a private or enterprise account.

- Create your log-in particulars by offering a username and password.

- Confirm your identification and supply particulars together with your title, birthday, and handle.

- Hyperlink your credit score or debit card. Have your financial institution, credit score, or debit card particulars able to enter.

- Register e mail: Full the registration course of along with your e mail handle.

- Non-obligatory: PayPal will ask in your cell phone quantity. That is to be able to ship you alerts on uncommon exercise, or to reset your password.

- After finishing these steps, you possibly can start utilizing your PayPal account.

The way to use PayPal to pay for gadgets

You need to use PayPal to pay on-line or in particular person

PayPal

When paying on-line, you simply have to search for the PayPal image and click on on the button that claims to take a look at with PayPal. This lets you take a look at by logging into your PayPal account relatively than sharing your cost info.

Not each on-line retailer accepts PayPal; for instance, Amazon would not instantly settle for PayPal. Whilst you cannot take a look at at Amazon by logging into your PayPal account, you possibly can sign up for a PayPal debit card that is linked to your PayPal account stability. You may then use this debit card quantity when trying out on-line, or use the bodily card in a retailer, to pay with PayPal from a retailer that does not instantly help the platform.

If you happen to obtain the PayPal app, you will see much more choices. Due to many partnerships with shops and eating places in your space, you get totally different choices for tips on how to pay for merchandise, meals or gasoline, and even order forward to beat the queues in some meals institutions and low retailers. The app reveals you an inventory of all of the distributors close by that settle for totally different PayPal choices.

Utilizing PayPal for on-line funds

- At checkout on an internet site, select PayPal as your cost methodology.

- Log in to your PayPal account when prompted.

- Assessment and ensure the cost particulars and full the transaction.

Utilizing PayPal for in-store funds

You need to use your PayPal account to pay in bodily shops the place PayPal is accepted. Another choice is to request a PayPal debit card, which is linked to your PayPal account stability and used like an everyday debit card.

- Search for shops that show the PayPal acceptance image.

- At checkout, let the cashier know you want to pay with PayPal.

- Relying on the shop’s know-how, you would possibly scan a QR code utilizing your PayPal app, or use a PayPal card linked to your account.

Utilizing the PayPal app:

- Open the PayPal app in your cellular system.

- Use the app to search out close by shops or providers that settle for PayPal.

- Select your most well-liked cost methodology throughout the app (like PayPal stability, linked checking account, or playing cards).

- Full the transaction as directed by the app.

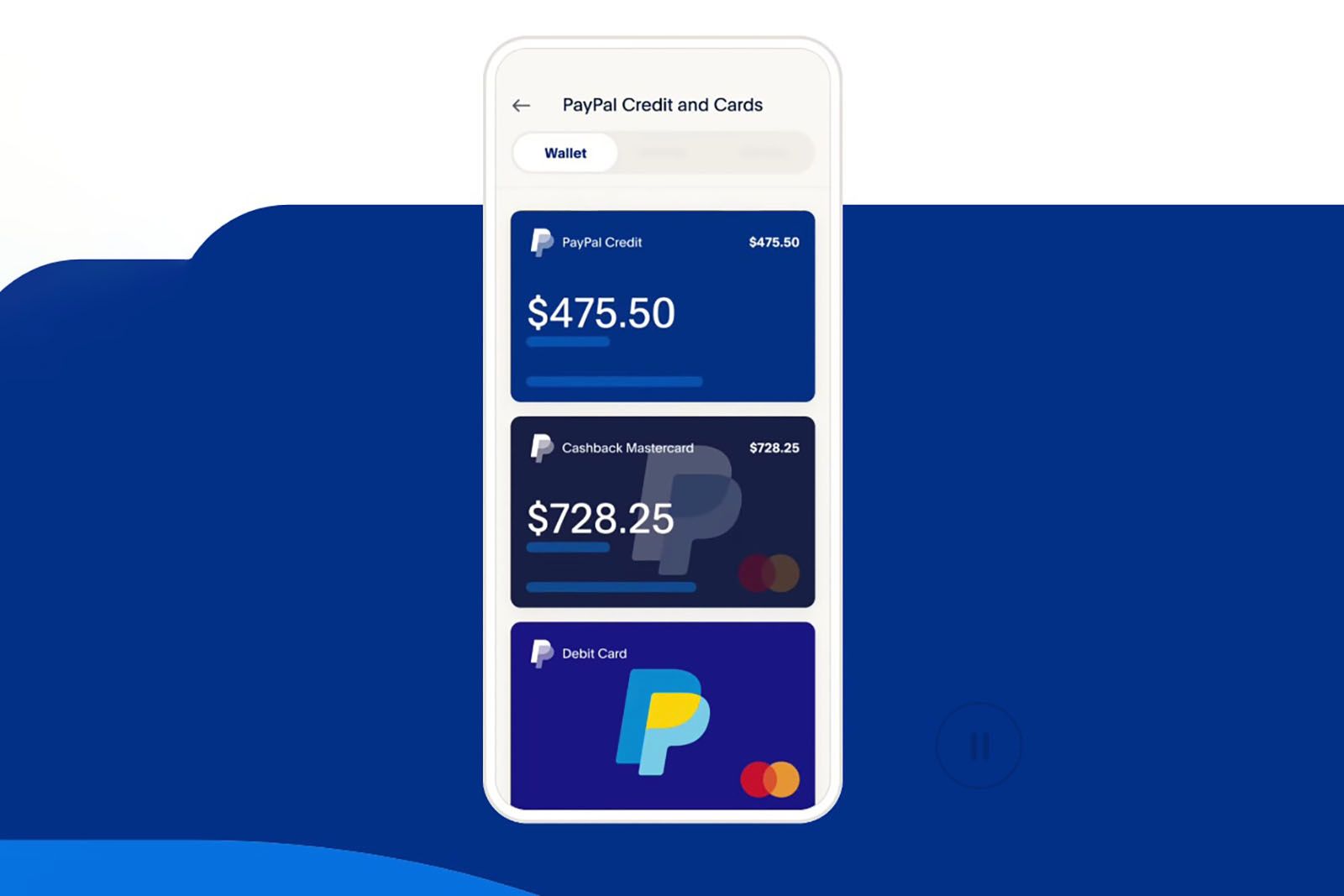

What’s PayPal Credit score?

PayPal Credit score is a digital line of credit score

PayPal

- Sort: Digital credit score line (not a bodily card).

- Credit score Verify: Sure, topic to credit score approval.

- Options: No curiosity on purchases of $99+ if paid in full in 6 months.

- Utilization: On-line, wherever PayPal is accepted.

- Charges: No annual payment.

PayPal additionally runs its personal credit score service, PayPal Credit, the place you possibly can pay for gadgets utilizing PayPal however pay for them later.

It’s a digital, reusable credit score line provided by PayPal that can be utilized for on-line purchases the place PayPal is accepted. It gives the pliability to pay over time. There isn’t a bodily card related to PayPal Credit score; it is solely on-line, built-in into your PayPal account for comfort. It fees a typical (variable) buy rate of interest every year, very similar to any bank card or mortgage, however as an incentive, you get 0 % curiosity on purchases of over $99 in the event you pay in full inside six months. So, in the event you pay it again inside that point, it will not value you greater than the unique buy worth.

Some shops provide particular offers when paying for merchandise utilizing PayPal Credit score, with decreased rates of interest relying on the retailer.

Associated

What is the Venmo Credit Card, how does it work, and does it offer rewards?

Do you know Venmo gives a bank card?

Does PayPal provide a bodily card?

PayPal has three choices for bodily playing cards

PayPal

Sure, PayPal gives the next bodily playing cards:

- The PayPal Cashback Mastercard: A bodily bank card that gives 3% money again on PayPal purchases and a pair of% on different transactions, with no annual payment. A credit score verify is required for approval, and it contains the standard Mastercard security measures.

- The PayPal Debit Card: A bodily card linked to your PayPal Steadiness, would not sometimes require a credit score verify. It is accepted all over the place Mastercard is and permits free withdrawals at MoneyPass® ATMs, all with out month-to-month charges or minimal stability guidelines.

- The PayPal Prepaid Mastercard: That is simple to get because it would not require a credit score verify. It is a bodily, pay as you go card, ideally suited for managing your spending with out overdraft charges, and it comes with a payment construction typical for pay as you go playing cards.

Does Paypal cost a payment?

PayPal fees charges, however purchasing on-line sometimes would not include any charges

Many PayPal customers can use the service with out paying a payment. Making a purchase order utilizing your PayPal account would not include any charges, offered you are not utilizing PayPal Credit score. You may also ship cash to a good friend with none charges in the event you use your PayPal stability or a debit card and are sending cash in the identical foreign money.

So the place does PayPal make its revenue? The shops and companies that settle for PayPal pay a small payment for every transaction, with a proportion of the cost going to PayPal. If you happen to use PayPal to just accept a cost, possibly since you bought one thing on eBay or to be paid in your facet gig or small enterprise, you’ll pay a small proportion of the cost to PayPal for utilizing the service. PayPal Credit score additionally comes with charges in the event you do not meet the interest-free necessities. PayPal additionally has charges for changing to a distinct foreign money and shopping for cryptocurrency. For the complete record of charges, visit PayPal’s fees page.

Why must you attempt PayPal?

PayPal is broadly accepted and has purchaser protections in place

PayPal

Whereas there are many on-line cost programs today, comparable to Apple Pay and Google Pay, PayPal gives a number of extra advantages that others may not.

Broadly accepted

To start with, its age means it’s well-established and broadly accepted, even by smaller retailers. You’ll find a Pay by PayPal possibility on hundreds of internet sites that don’t provide the identical for Apple Pay or different digital monetary providers. You may also use PayPal past the retailers that permit the cost platform by requesting a PayPal debit card and utilizing it anyplace that accepts MasterCard.

Purchaser safety

PayPal’s purchaser safety safeguards can even make sure you get a refund if an merchandise you purchase on-line would not arrive or would not match a vendor’s description. These promoting gadgets on a private or enterprise stage and are paid by means of PayPal are additionally protected. For instance, in the event you can present proof that you simply despatched an merchandise by publish but the customer claims to not have obtained it, you get to maintain the complete cost.

Layer of safety

Another excuse to make use of PayPal is that it gives an extra layer of safety to funds. As you shouldn’t have to enter your card particulars or CCV quantity every time you buy one thing, simply your PayPal login and password or cellular quantity and PIN, the web retailer doesn’t have your particulars in its database.

OneTouch

Generally you may also use OneTouch funds, the place PayPal retains you logged in in the event you activate the service, and also you shouldn’t have to enter your particulars every time you buy one thing, irrespective of which retailer. That is as a result of it’s particular to a tool and browser. For instance, in the event you allow OneTouch in your PC, it’s going to solely work whenever you use that particular laptop and the identical browser. This makes trying out on-line sooner, and you do not have to depart the sofa to go seize your pockets.

Devoted PayPal apps

There are devoted PayPal apps for iPhone and Android gadgets — every with biometric safety for further safety.

Loyalty playing cards

You may add loyalty playing cards to your PayPal account, to be able to achieve loyalty factors everytime you pay for one thing utilizing the app.

Trending Merchandise

Cooler Master MasterBox Q300L Micro-ATX Tower with Magnetic Design Dust Filter, Transparent Acrylic Side Panel, Adjustable I/O & Fully Ventilated Airflow, Black (MCB-Q300L-KANN-S00)

ASUS TUF Gaming GT301 ZAKU II Edition ATX mid-Tower Compact case with Tempered Glass Side Panel, Honeycomb Front Panel, 120mm Aura Addressable RGB Fan, Headphone Hanger,360mm Radiator, Gundam Edition

ASUS TUF Gaming GT501 Mid-Tower Computer Case for up to EATX Motherboards with USB 3.0 Front Panel Cases GT501/GRY/WITH Handle

be quiet! Pure Base 500DX ATX Mid Tower PC case | ARGB | 3 Pre-Installed Pure Wings 2 Fans | Tempered Glass Window | Black | BGW37

ASUS ROG Strix Helios GX601 White Edition RGB Mid-Tower Computer Case for ATX/EATX Motherboards with tempered glass, aluminum frame, GPU braces, 420mm radiator support and Aura Sync

CORSAIR 7000D AIRFLOW Full-Tower ATX PC Case – High-Airflow Front Panel – Spacious Interior – Easy Cable Management – 3x 140mm AirGuide Fans with PWM Repeater Included – Black